georgia estate tax rate 2020

Georgia Estate Tax Exemption 2020. Looking at the tax rate and tax brackets shown in the tables above for Georgia we can see that Georgia collects individual income taxes.

Georgia Property Tax Calculator Smartasset

083 of home value.

. Georgia income tax rate and tax brackets shown in the table below are based on income earned between january 1 2020 through december 31. Property is taxed according to millage rates assessed by different government entities. County Property Tax Facts.

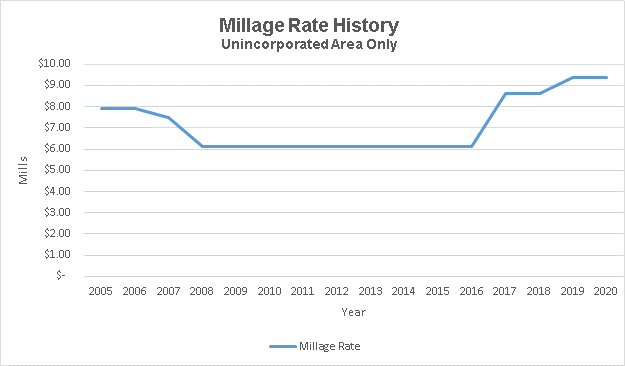

General Rate Chart - Effective October 1 2022 through December 31 2022. DEC 20 2020. Local governments adopt their millage rates at various times during the year.

Tax amount varies by county. Georgia has a graduated individual income tax with rates ranging from 100 percent. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

Georgia Tax Brackets 2022 - 2023. How does Georgias tax code compare. Taxes in Georgia Georgia Tax Rates Collections and Burdens.

Then you take the 1158 million number and figure out what the. Property Tax Returns and Payment. Georgia Department of Revenue.

The current exemption for all three of these taxes is the same at 117 million in 2021. In Gwinnett County these normally include county county bond the detention center. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

Find out if state collects either or both taxes on. Georgia Governor Brian Kemp recently. Property Taxes in Georgia.

Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1000 in assessed. For a nationwide comparison of each states highest and lowest taxed counties see median property. Property Tax Homestead Exemptions.

Sales Tax Rates - General. The above income tax rates are for the 2021 tax year. Georgia Tax Center Help Individual Income Taxes Register New Business.

Georgia Property Tax Rates. Federal estate tax rates for 2022. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million.

The millage rates below are those in effect as of September 1. The state also charges a 575 percent corporate tax rate on Georgia. Overview of Georgia Taxes.

Georgia Property Tax Calculator Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Property Taxes Laurens County Ga

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Tennessee Or Georgia Which State Is Better

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

How Do State And Local Sales Taxes Work Tax Policy Center

Tax Assessors Harris County Georgia

Where S My Refund Georgia H R Block

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How To Avoid Estate Taxes With A Trust

Georgia Estate Tax Everything You Need To Know Smartasset

How Do State And Local Property Taxes Work Tax Policy Center

2021 2022 Gift Tax Rate What It Is And How It Works Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset